With farmed salmon supply trends unlikely able to catch up with the robust demand for salmon globally, there is a “massive window of opportunity” for industry stakeholders over the next decade, says the CEO of aquaculture technology provider AKVA Group, Knut Nesse.

Salmon supply from conventional farming is projected to grow by just a little over 3 percent to 3.7 million tonnes to 2030 while demand is seen growing by over 5 percent to 4.5 million tonnes during the period. The RAS segment’s anticipated 800,000-tonne production in 2030 would still not be enough to cover the supply shortfall.

“We really, really see a strong fundamental for salmon in the coming decade all the way to 2030,” says Nesse.

“We think there is appetite for salmon driven by the key drivers: very positive sentiment for consumption of salmon. There is a real consensus that demand potential is going to stay at 5 percent (growth) on a price-neutral basis – that’s what all players, analysts and everybody believe. However, we think that the supply potential is way less and it’s probably going to be at the maximum of 3 percent annual growth, so there is some massive window of opportunity between supply growth and the demand potential.”

Nesse offered his outlook during the company’s presentation of its Q1 2022 financial results, where he also noted the macroeconomic trends that influenced the bottom line and the industry trends he’s seeing.

“The Russia-Ukraine war has certainly intensified inflation and supply chain disruptions worldwide. (These had) significant implications on our profitability. There was exponential increase in freight rates and energy prices. We also saw increased prices on some raw materials, in particular some electronical components. There was also delay on some land-based projects,” he said.

EBITDA for Q1 2022 rose 22.8 percent to NOK102 million. The dramatic increase in freight prices was the one costly “incident” that impacted EBIT which stood at NOK59 million, he said.

“The increase in freight rates impacted the EBIT by NOK30 million, which is (more than) 40 percent of the total. It was due to one incident: the two barges completed in a shipyard in Vietnam saw cost-overruns in double-digits for bringing them over to Norway compared to the sold freight cost. So that is one single incident, costing quite some money.”

He said the company has, since July 2021, changed its contract practice so that the customer now pays for the freight. “So, we have kind of close that issue, but it came with a cost for this quarter.”

TRENDS

Post-smolt market

Nesse sees the salmon producers’ use of land-based facilities to grow smolts to 750 grams and then stocking them at sea to grow them to 5 kilos over a period of eight or nine months as a winning proposition.

“The combination of post-smolt size of up to 1kg, short production time in the sea, and less – if any – sea lice treatment, that’s a win-win. We think that’s the best growth opportunity you have in the Norwegian Market these days… because you typically can utilize your license even more plus the additional growth you get on land.”

He says the relaxed travel restrictions have allowed his team to travel to see customers and they’re seeing “great interest” in growing smolts longer on land-based facilities. “We are very hopeful that the post-smolt market will see a very, very strong momentum in the coming years.”

RAS

Farming salmon in a complete cycle on land to a growout size of 4-5 kilos “is really part of the solution to close the supply gap going forward,” noted Nesse.

But he acknowledged that land-based farming will require major capex investments of around NOK160 billion. That’s an estimated 200 NOK/kg capex investment for land-based versus 20 NOK/kg for conventional production.

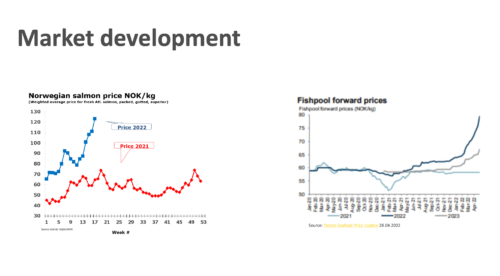

Salmon prices

Prices are spiking “so there’s a very strong sentiment there and for us that’s really important because that’s fuelling a high activity level going forward. That’s above our expectations and we see that also in the marketplace, there’s quite good activity level,” he says.

Based on the ongoing recovery of the HoReCa segment coupled with the salmon supply remaining very low for the year, “we see that prices for the full year of 2022 and for next year reaching a new level. So maybe the new floor is set to be NOK80.”

Sea-based

Although conventional farming has reached its maximum growth capacity, Nesse still sees opportunities in this segment.

“Why do I say a double-digit growth is strong in the cage farming segment when the volume growth for salmon is 3 percent? That’s because of modernization, professionalization, (the industry’s venture) to more exposed sites, etc. That’s why you have a growth on the technology, which is more than the biomass growth.

He says AKVA is strengthening its capacity in delivering solutions in precision farming as well as deep-sea farming.